flow through entity taxation

110 Lowest Price Guarantee. Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence.

Pass Through Taxation What Small Business Owners Need To Know

FTE Tax Credit and.

. As a result only the individuals not the business are taxed. Flow through entity business types taxes income. Flow-Through Entity FTE Tax Credit.

Everything you need to know. FTE Tax Credit FAQs. That is the income of the entity is treated as the income of the investors or owners.

Types of Pass-Through Entities. However the late filing of 2021 FTE returns will be. The Michigan FTE tax.

Flow-through entities are considered to be pass-through entities. A flow-through entity is also called a pass-through entity. A flow-through entity FTE is a legal entity where income flows through to investors or owners.

Therefore LLC owners cant be held personally liable for the debts and obligations of the business. With that said the LLC isnt a separate tax entity. FTE Tax Credit FAQ.

Log on to Michigan Treasury Online MTO to update. LLC Income Tax Overview. Changes to 9-1-1 Under Senate Bill 400 PA 51 Filing Deadlines and Due Dates New Marihuana.

This means that the flow-through entity is responsible. Flow-Through Entity Tax - Ask A Question. Instead all income of the business is passed through to the owners who report it on their personal income tax return and pay taxes at their effective marginal rate.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. This amount generally correlates to the business. The range of features that comprise each method of taxation entity taxation and flow-through taxation are set out in previous work see here and here.

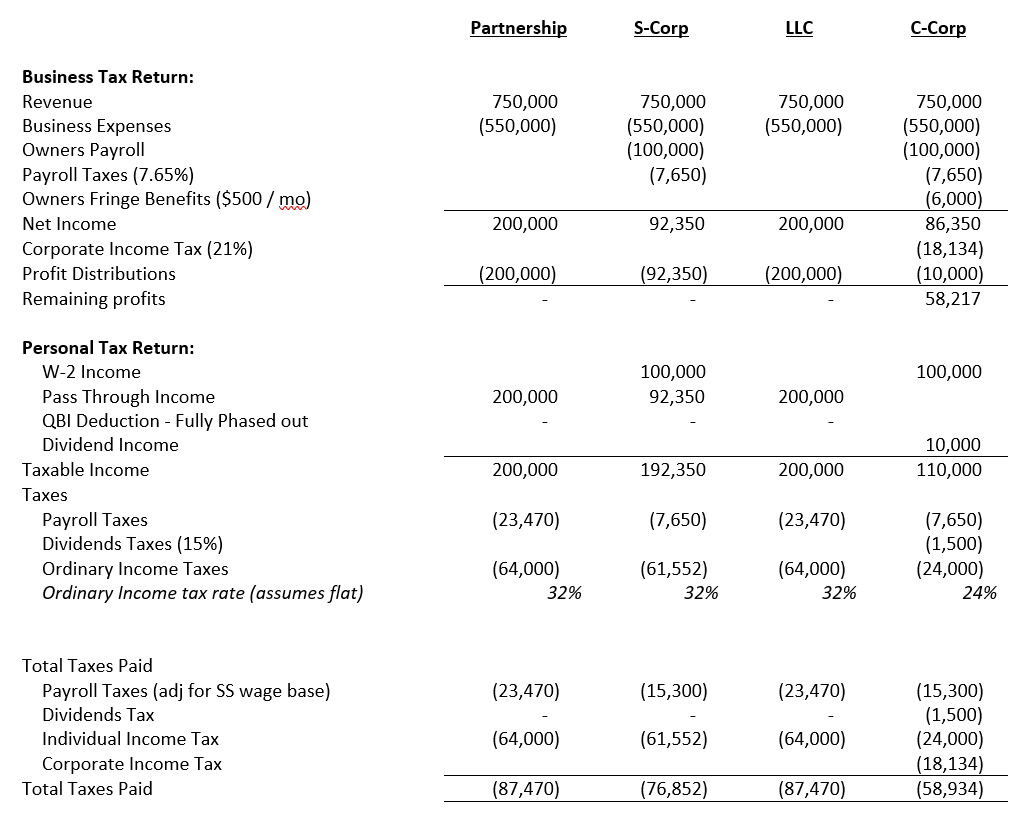

My recent article critically analysed. Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. The tax allows the entity remitting the Michigan tax a.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. With sole proprietorships LLCs partnerships and S corporations business income flows through to the business owners and is taxed only at the individual. Understanding What a Flow-Through Entity Is.

A trust maintained primarily for the benefit of. Instructions for Electing Into and Paying the Flow-Through Entity Tax Taxpayer Notice. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation.

A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. Instead their owners include their allocated shares of profits in. Michigans flow-through entity tax presents new planning opportunities as well as new complexities and requirements.

View FTE Business Tax FAQ. General FTE Tax Credit. Is elected and levied on the Michigan portion of the positive business income tax base of a flow-through entity.

Ab 150 Passthrough Entity Elective Tax Devereaux Kuhner Co Llp

Pass Through Entity Definition And Types To Know Quickbooks

Pass Through Income Meaning Example Investinganswers

Pass Through Entity Definition Examples Advantages Disadvantages

Business Entity Comparison Harbor Compliance

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Flow Through Entity Overview Types Advantages

Pass Through Entity Tax 101 Baker Tilly

Sole Proprietorships And Flow Through Entities Ppt Download

Pass Through Entity Definition And Types To Know Quickbooks

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Elective Pass Through Entity Tax Wolters Kluwer

What Is A Pass Through Entity Definition Meaning Example

Pass Through Entity Definition And Types To Know Quickbooks

What Is A Pass Through Entity Youtube

The Other 95 Taxes On Pass Through Businesses Econofact

How To Choose Your Llc Tax Status Truic

Pass Through Entity Definition Examples Advantages Disadvantages